TEXAS LIQUOR LAW ATTORNEYS

We focus on liquor law so that you can focus on business.

TEXAS LIQUOR LAW ATTORNEYS:

WELCOME TO MONSHAUGEN & VAN HUFF, P.C.

With over 100 combined years of experience practicing all facets of Texas liquor law, the Houston-based TABC attorneys at Monshaugen & Van Huff, P.C. have represented a wide-range of clients including hotels, bars, retailers, nightclubs, and restaurants in the Lone Star State. We represent both local and national clientele.

We believe that it takes legal knowledge, practical experience, and personal relationships to provide the most effective legal representation to our clients.

Our TeamPRACTICE AREAS

OUR AREAS OF EXPERTISE INCLUDE:

The well-respected Monshaugen & Van Huff, P.C. liquor law TABC attorneys have established connections with staff members in the Austin-based district offices and headquarters of the Texas Alcoholic Beverage Commission (TABC), in addition to the Attorney General’s and Comptroller’s offices in Texas, the City of Houston and other municipal agencies. Due to these relationships, we can professionally and efficaciously help our clients negotiate the multifaceted regulatory landscape wherein they operate. Although our firm is based in Houston, we frequently represent hospitality industry clients in cities throughout Texas, including Austin, Dallas, San Antonio, El Paso, Beaumont, and Corpus Christi.

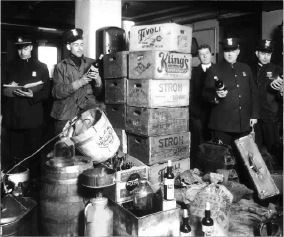

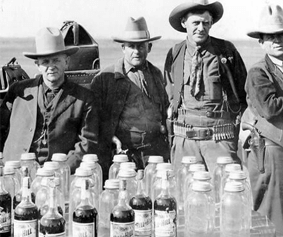

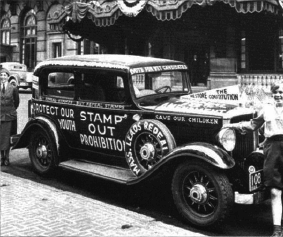

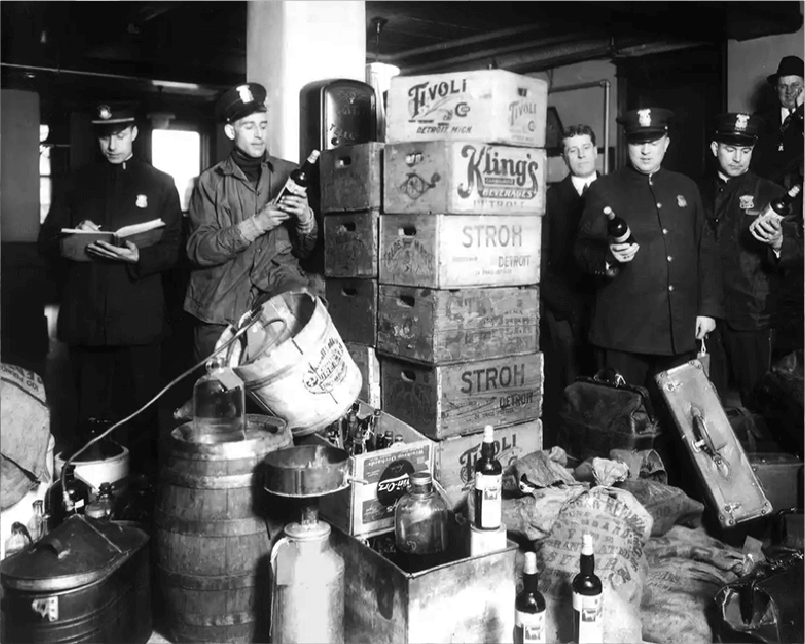

TEXAS LIQUOR LAW

OUR TABC ATTORNEYS

Our attorneys have over 100 years of combined experience and have handled over five hundred TABC administrative cases and civil actions before the Texas Alcoholic Beverage Commission, the Texas State Office of Administrative Hearings, Texas District and Appellate Courts, the Texas Supreme Court, United States District and Appellate Courts, and the Supreme Court of the United States