Texas Liquor License

You need a liquor license from the Texas Alcoholic Beverage Commission (TABC) before you can sell or serve alcohol in Texas.

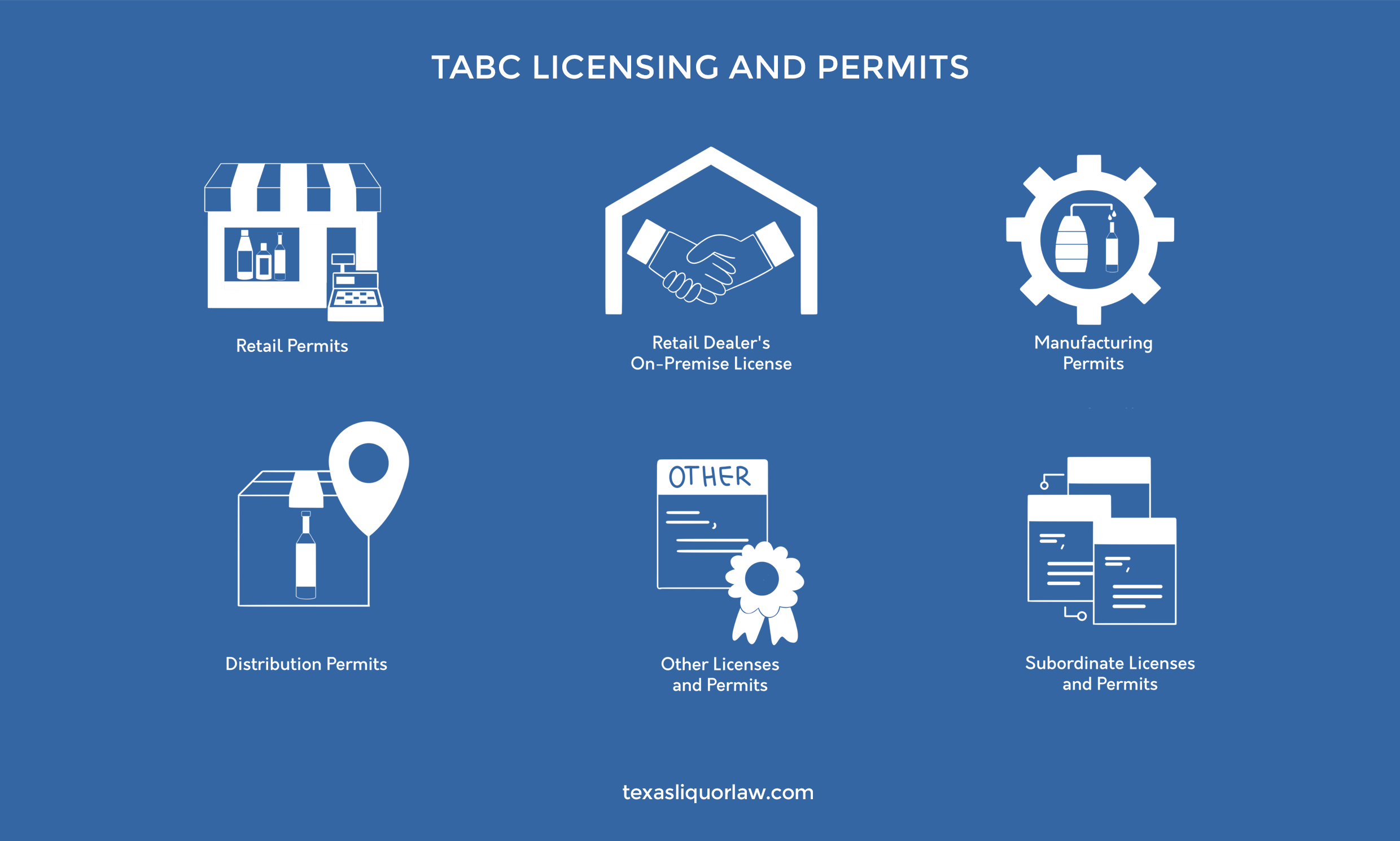

Choosing the right TABC Permit for your business

Are you looking to obtain a Texas liquor license for your business? Monshaugen & Van Huff, P.C. routinely assists clients in obtaining the following types of TABC Licenses and Permits:

TABC License Types

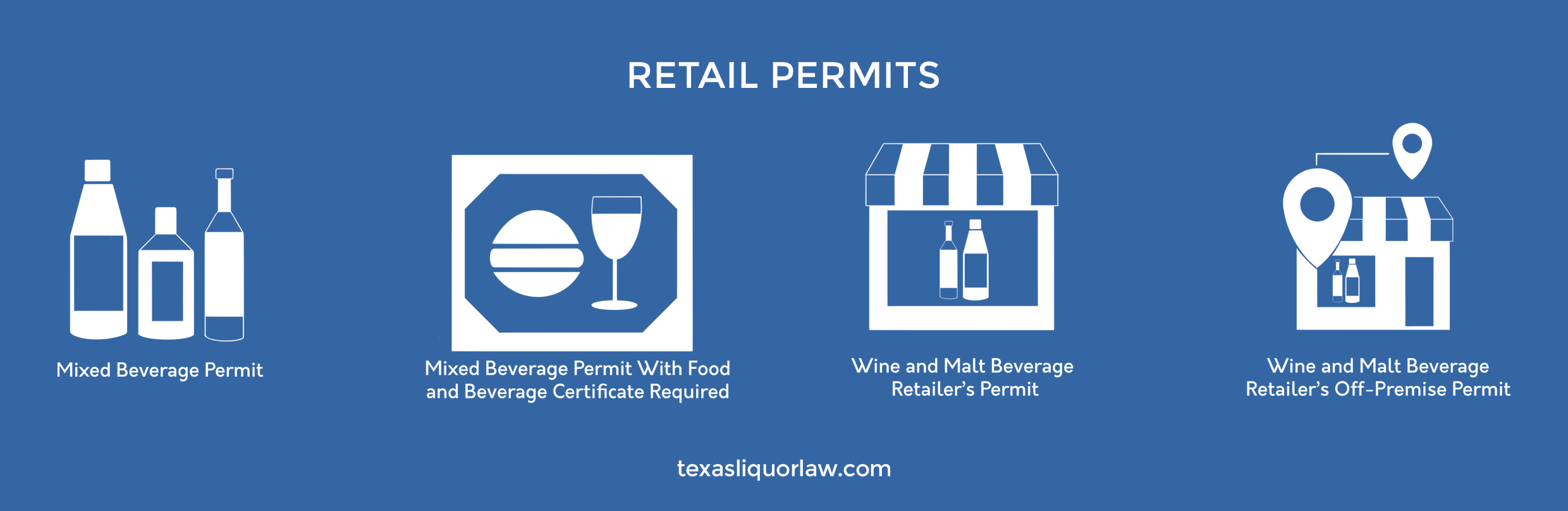

Retail Permits

Mixed Beverage Permit

Authorizes the sale of distilled spirits, wine and malt beverages for on-premise consumption. It includes authority to transport alcoholic beverages from the place of purchase to the Mixed Beverage Permit’s licensed premises, provide guestroom minibars (hotels), and hold events at a temporary location away from the primary mixed beverage permit premises (there will be an approval process Mixed Beverage Permit holders must follow).

Mixed Beverage Permit with Food and Beverage Certificate Required

In certain circumstances, Mixed Beverage Permit holders must have a Food and Beverage Certificate. The Mixed Beverage Permit with Food and Beverage Certificate Required is a designation that notes this requirement.

Wine and Malt Beverage Retailer’s Permit

Authorizes the sale of wine and malt beverages for on- and off-premise consumption. It also includes authority to hold events at a temporary location away from the primary Wine and Malt Beverage Retailer’s Permit premises (there will be an approval process Wine and Malt Beverage Retailer’s Permit holders must follow).

Wine and Malt Beverage Retailer’s Off-Premise Permit

Authorizes the sale of malt beverages and wine for off-premise consumption.

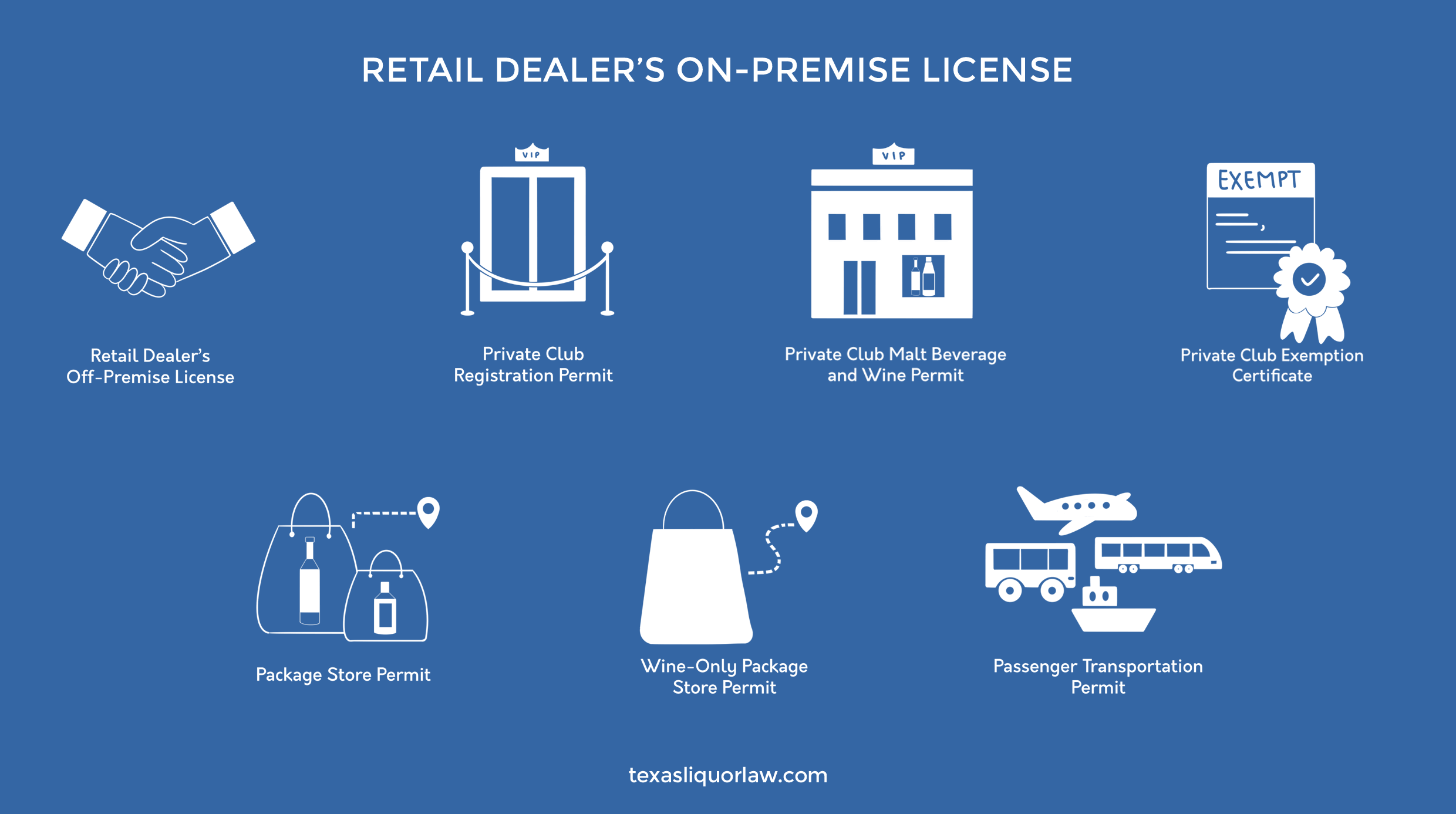

Retail Dealer’s On-Premise License

Authorizes the sale of malt beverages for on-premise consumption. Grandfathered Retail Dealer’s On-Premise License holders in beer-only local option areas can sell malt beverages of up to 5% alcohol by volume. It includes authority to hold events at a temporary location away from the primary Retail Dealer’s On-Premise License premises (there will be an approval process that Retail Dealer’s On-Premise License holders must follow). This license allows the holder to sell beer for consumption on or off the premises where the beverage is sold in a lawful container to the ultimate consumer. The holder may not sell the beer for resale. The license requires an adequate seating area for customers.

Retail Dealer’s Off-Premise License

Authorizes the sale of malt beverages for off-premise consumption. Grandfathered Retail Dealer’s Off-Premise License holders in beer-only local option areas can sell malt beverages of up to 5% alcohol by volume.

Private Club Registration Permit

Authorizes the storage and service of distilled spirits, wine and malt beverages for club members’ on-premise consumption, even in dry areas. It includes authority to transport alcoholic beverages from the place of purchase to the private club’s licensed premises and to hold events at a temporary location away from the primary Private Club Registration Permit premises (there will be an approval process that Private Club Registration Permit holders must follow).

Private Club Malt Beverage and Wine Permit

Authorizes the storage and service of malt beverages and wine for club members’ on-premise consumption, even in dry areas. It includes authority to transport alcoholic beverages from the place of purchase to the private club’s licensed premises and to hold events at a temporary location away from the primary Private Club Malt Beverage and Wine Permit premises (there will be an approval process that Private Club Malt Beverage and Wine Permit holders must follow).

Private Club Exemption Certificate

Authorizes fraternal and veterans’ organizations to serve alcoholic beverages to the organization’s members and their guests. It includes authority to transport alcoholic beverages from the place of purchase to the private club’s licensed premises and to hold events at a temporary location away from the primary Private Club Exemption Certificate premises (there will be an approval process that Private Club Exemption Certificate Permit holders must follow).

Package Store Permit

Authorizes the sale of distilled spirits, wine and malt beverages to consumers for off-premise consumption. It includes authority for the package store to transport its inventory between its other licensed locations within the same county, to transport alcoholic beverage orders to its end-consumer customers (certain limitations apply), and to conduct product tastings on the package store premises.

Wine-Only Package Store Permit

Authorizes the sale of malt beverages and wine to consumers for off-premise consumption. It includes authority for the Wine-Only Package Store Permit holder to transport its inventory between its other licensed locations within the same county, to transport alcoholic beverage orders to its end-consumer customers (certain limitations apply), and to conduct product tastings on the permitted premises.

Passenger Transportation Permit

Authorizes airlines, buses, boats, and trains to sell and serve distilled spirits, wine, and malt beverages for onboard consumption.

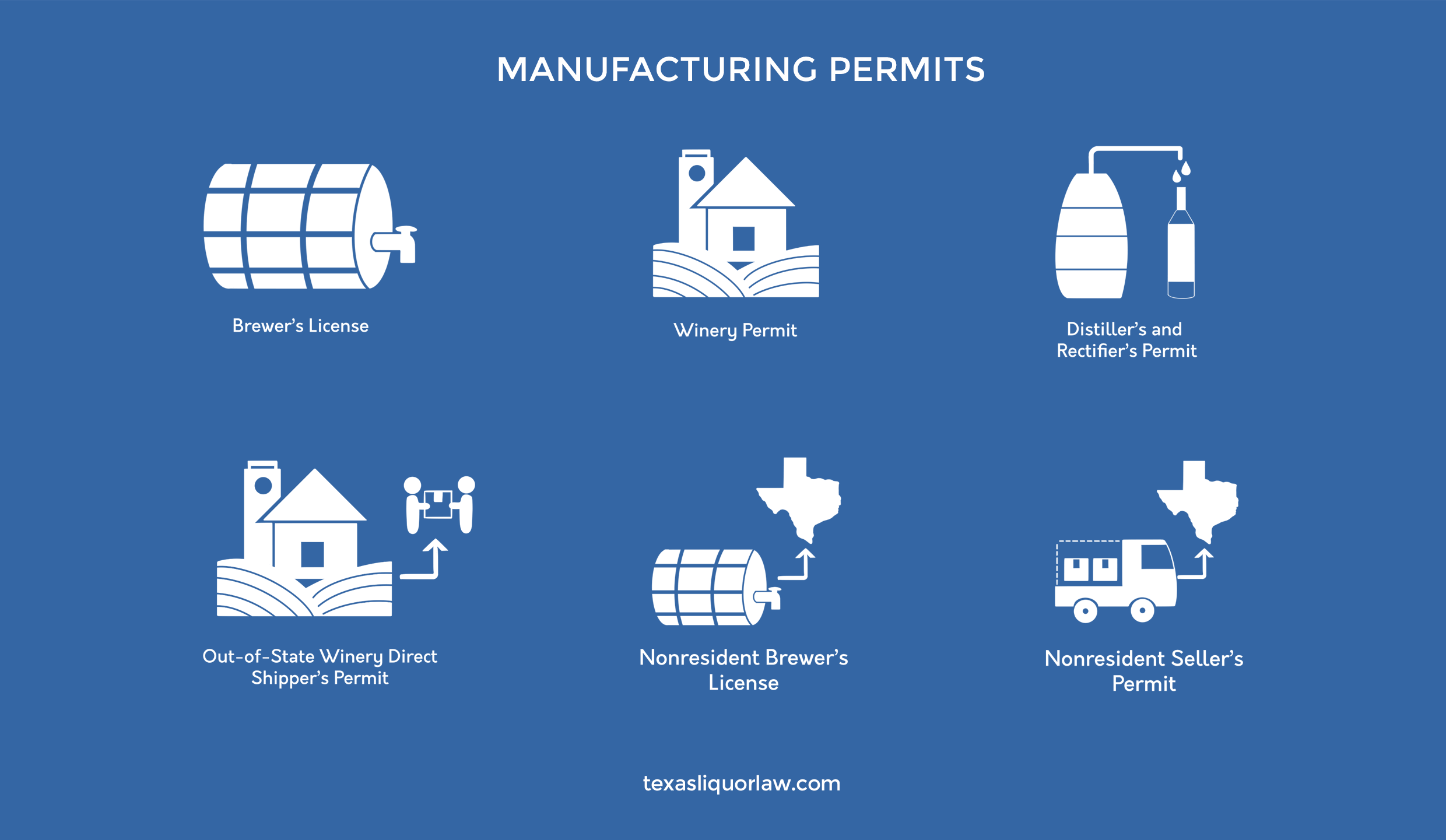

Manufacturing Permits

Brewer’s License

Authorizes the holder to manufacture malt beverages, import malt beverages from out of state, transport malt beverages from the place where the Brewer’s License permit holder purchased them to the Brewer’s License permit holder’s business, transfer malt beverages from the place of sale or distribution to the TABC-licensed or permitted purchaser, store malt beverages, and under certain conditions sell its malt beverages to consumers for on- or off-premise consumption.

Winery Permit

Authorizes the manufacturing of wine. It includes the ability to transport alcoholic beverages from the place of purchase to the permit holder’s business and from the place of sale or distribution to the purchaser, store wine, sell to consumers for on- or off-premise consumption, conduct off-premise deliveries to consumers, and to conduct wine festivals (there will be an approval process that Winery Permit holders must follow).

Distiller’s and Rectifier’s Permit

Authorizes the holder to manufacture distilled spirits and to rectify, purify, refine, or mix distilled spirits and wines. It includes the authority to transport alcoholic beverages from the place of purchase to the permit holder’s business and from the place of sale or distribution to the TABC-licensed or permitted purchaser, and to store the products produced by the permit holder. Under certain conditions, the holder can sell their alcoholic beverages to consumers for on- or off-premise consumption.

Out-of-State Winery Direct Shipper’s Permit

Authorizes out-of-state wineries to ship wine directly to consumers.

Nonresident Brewer’s License

Authorizes out-of-state brewers to sell malt beverages to Texas-based TABC license holders that are authorized to import those beverages into Texas. It also authorizes transportation to those Texas importers. Authorized Texas importers of malt beverages hold a Brewer’s License, General Distributor’s License or Branch Distributor’s License.

Nonresident Seller’s Permit

Authorizes the holder to sell and ship distilled spirits and wine to Texas-based TABC license or permit holders that are authorized to import those beverages into Texas. Authorized Texas importers of distilled spirits or wine include the holders of a:

- Distiller’s and Rectifier’s Permit

- Winery Permit

- Wholesaler’s Permit

- General Class B Wholesaler’s Permit

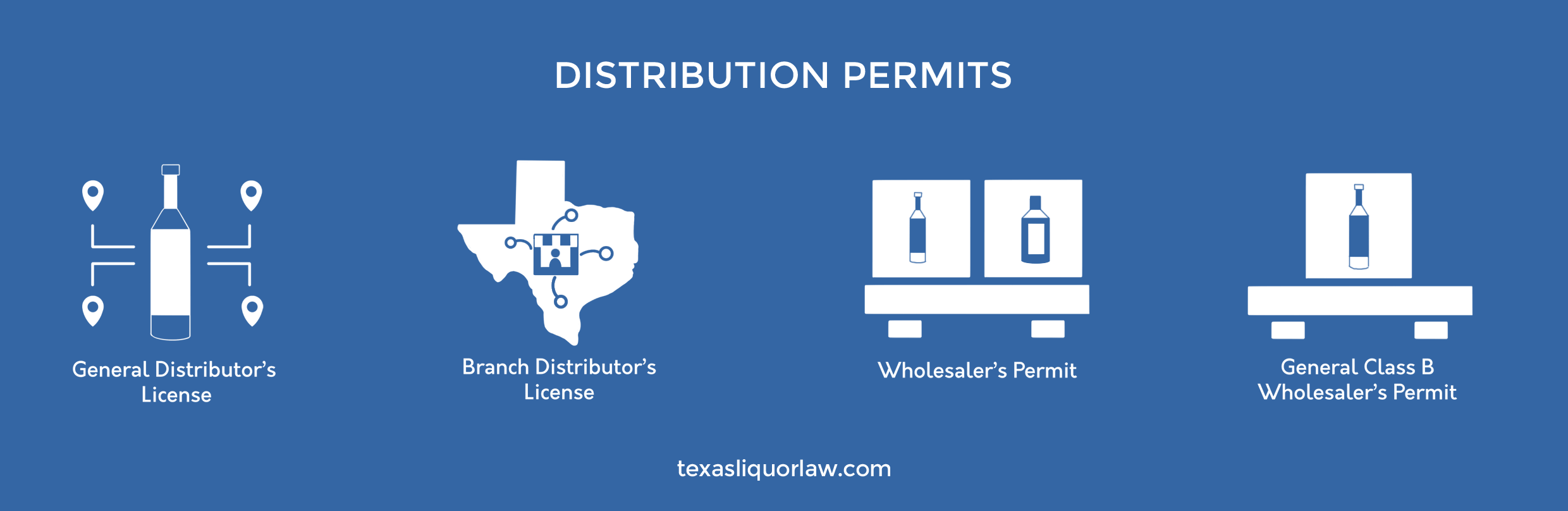

Distribution Permits

General Distributor’s License

Authorizes the distribution of malt beverages. It includes the authority to import malt beverage products and transport products from the place of purchase to the permit holder’s business and from the place of sale or distribution to the purchaser.

Branch Distributor’s License

For holders of a General Distributor’s License, it authorizes a general distributor to expand its distributing business to additional locations in any Texas county where the sale of malt beverages is legal.

Wholesaler’s Permit

Authorizes the distribution of distilled spirits and wine. It includes the authority to import distilled spirits and wine, transport products from the place of purchase to the permit holder’s business and from the place of sale or distribution to the purchaser, and to store products.

General Class B Wholesaler’s Permit

Authorizes the distribution of wine. It includes the authority to import wine, transport wine products from the place of purchase to the permit holder’s business and from the place of sale or distribution to the purchaser, and to store the products.

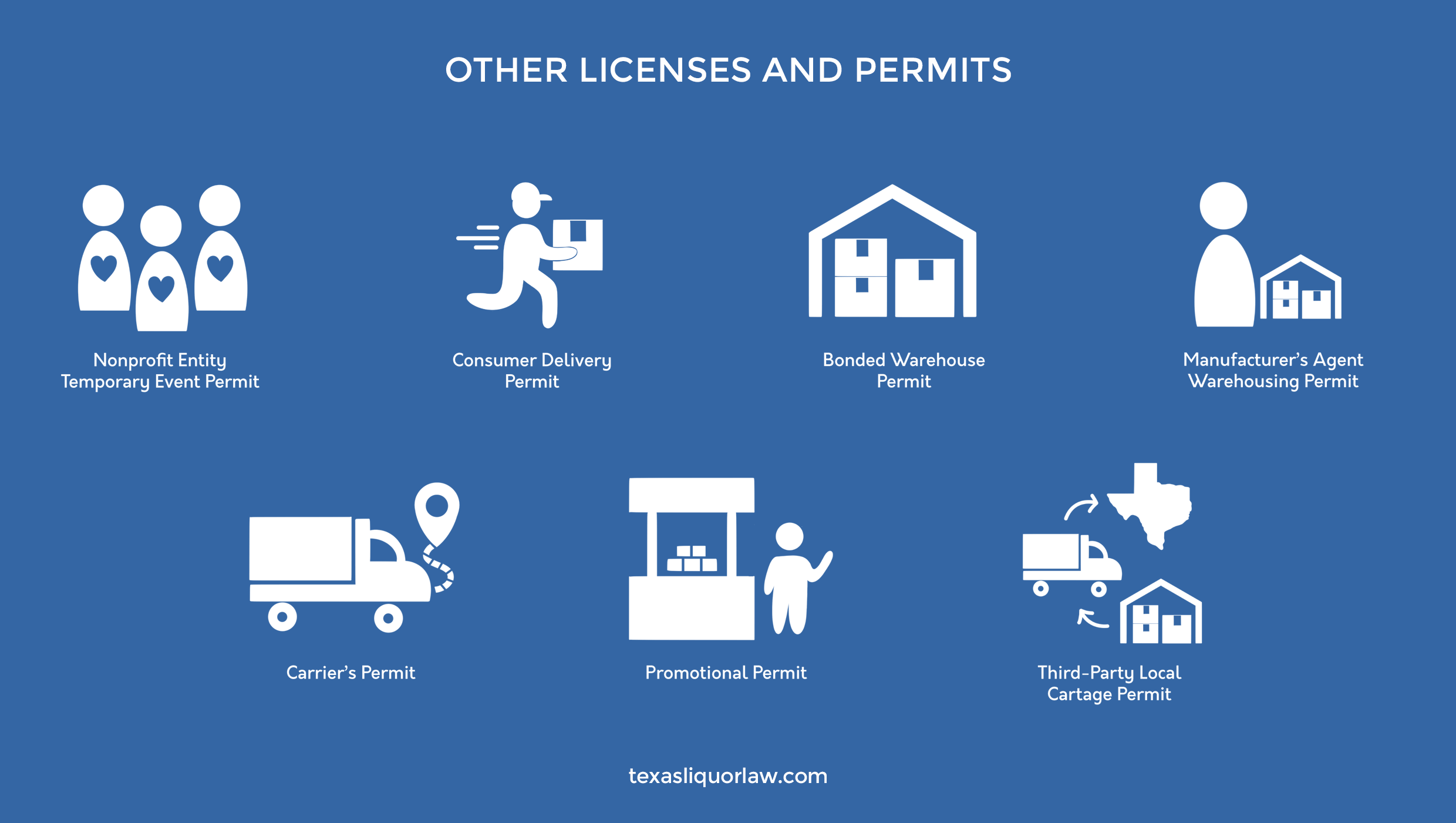

Other Licenses and Permits

Nonprofit Entity Temporary Event Permit

Authorizes certain organizations to sell, serve and auction alcoholic beverages at a temporary event.

Consumer Delivery Permit

Authorizes retailers and delivery companies, and their delivery drivers, to deliver alcoholic beverages sold by a retailer from the retailer’s premises to the ultimate consumer.

Bonded Warehouse Permit

Authorizes the holder to store distilled spirits and wine for producers and wholesalers.

Manufacturer’s Agent’s Warehousing Permit

Authorizes the holder to store malt beverages imported from Mexico for export out of Texas.

Carrier’s Permit

Authorizes the holder to take possession of and deliver distilled spirits and wine from the sender to a pre-determined recipient. Carrier’s Permit may be issued to a water carrier, airline, railway, motor carrier registered under Chapter 643 of the Transportation Code, or a common carrier operating under a certificate issued by the Interstate Commerce Commission.

Promotional Permit

Authorizes the holder to conduct product tastings on behalf of manufacturing tier licensees and permittees.

Third-Party Local Cartage Permit

Authorizes warehouses and transfer companies to transport and deliver distilled spirits and wine on behalf of other regulated businesses inside the corporate limits of any city or town in Texas.

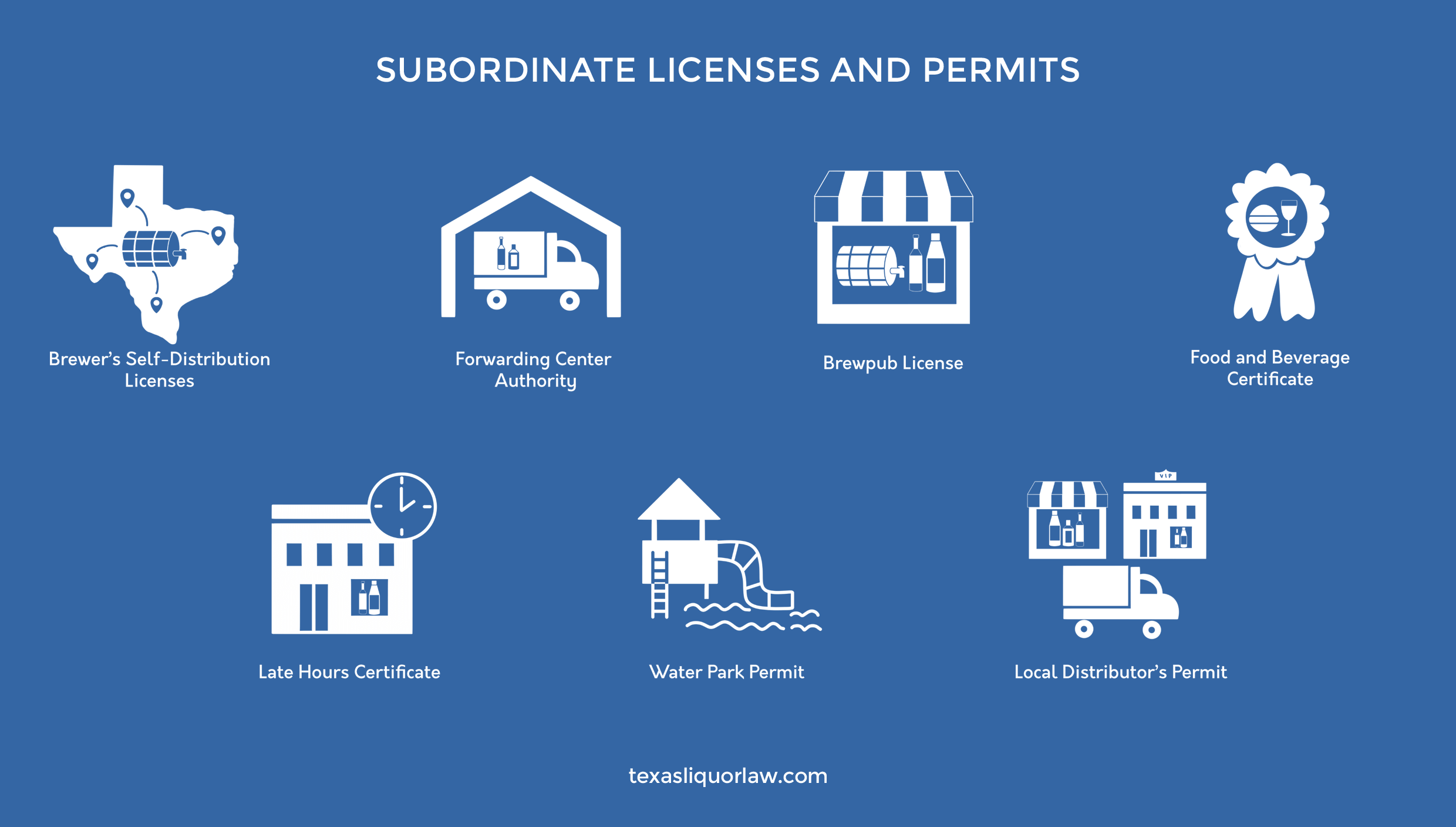

Subordinate Licenses and Permits

Brewer’s Self-Distribution License

For holders of a Brewer’s License that meet certain production thresholds, it authorizes brewers to sell malt beverages that they produce to retailers, distributors and wholesalers who are authorized to sell malt beverages in Texas.

Forwarding Center Authority

For holders of a Brewer’s License, Distiller’s and Rectifier’s Permit, Winery Permit, Nonresident Brewer’s License, or Non-Resident Seller’s Permit. It authorizes a holder who is transporting alcoholic beverages into and around the state to temporarily hold the beverages in a regional forwarding center. The center must be in an area that allows the sale of the type of alcoholic beverages (also known as a “wet” area) temporarily held in the forwarding center. City and county certifications are required.

Brewpub License

For holders of a Mixed Beverage Permit, Wine and Malt Beverage Retailer’s Permit, or Retail Dealer’s On-Premise License. It authorizes a holder to brew, bottle, can, package, and label malt beverages. It authorizes the holder to sell the malt beverages it produces to ultimate consumers at the brewpub for on- or off-premise consumption.

Food and Beverage Certificate

For holders of a:

- Mixed Beverage Permit

- Wine and Malt Beverage Retailer’s Permit

- Retail Dealer’s On-Premise License

- Private Club Registration Permit

- Private Club Malt Beverage and Wine Permit

- Private Club Exemption Certificate

To qualify for this certificate, a business must either be defined as a “restaurant” under the law or keep the business’s alcohol sales to 60% or less of its total sales, along with other requirements (see Senate Bill 911, 87R and TABC Rule 33.5).

Late Hours Certificate:

For holders of a:

- Mixed Beverage Permit

- Wine and Malt Beverage Retailer’s Permit

- Retail Dealer’s On-Premise License

- Private Club Registration Permits

- Private Club Malt Beverage and Wine Permit

- Private Club Exemption Certificate

It authorizes the holder to sell and/or serve between the hours of midnight and 2 a.m.

Water Park Permit

For holders of a Wine and Malt Beverage Retailer’s Permit that operate a water park located primarily along the banks of the Comal River. If the holder has a Water Park Permit at two or more water park locations, the holder may transport alcoholic beverages between the premises of all water parks for which the holder has a Water Park Permit.

Local Distributor’s Permit

For holders of a Package Store Permit, it authorizes holders to sell all types of alcoholic beverages to Mixed Beverage Permits and Private Club Registration Permits.

TABC Frequently Asked Questions

What is the legal drinking age in Texas?

The legal drinking age in Texas is 21 years old.

What kind of businesses require a TABC license?

Any business that sells, serves, or manufactures alcoholic beverages in Texas requires a TABC license.

How much does a TABC license cost in Texas?

The cost of a TABC license in Texas varies depending on the type of license you need. Retail permits for selling beer and wine typically cost between $150 and $600, while permits for selling distilled spirits can cost over $3,000. For a detailed breakdown and further insights, read more about Texas liquor license costs.

Do I need a TABC license to serve alcohol at a private event?

No, you do not need a TABC license to serve alcohol at a private event that is not open to the public, such as a wedding or birthday party. If you’re interested in learning more about specific alcohol licensing requirements, visit our guide for detailed information on private clubs and TABC regulations.

Can I sell alcohol without a TABC license in Texas?

No, it is illegal to sell alcohol without a TABC license in Texas.

How long is a TABC license valid for in Texas?

TABC licenses in Texas are typically valid for two years.

Can I apply for a TABC license online?

Yes, you can apply for a TABC license online through the TABC’s website.

Can I apply for multiple TABC licenses at once?

Yes, you can apply for multiple TABC licenses at once if you need more than one type of license for your business.

How often do I need to renew my TABC license in Texas?

TABC licenses in Texas must be renewed every two years. For a smooth and hassle-free renewal process, learn more about the TABC license renewal process.

Can I sell alcohol at a temporary event in Texas?

Yes, you can obtain a temporary permit from the TABC to sell alcohol at a temporary event, such as a festival or fair.

Can I sell alcohol after 2:00 a.m. in Texas?

No, alcohol sales in Texas are prohibited between 2:00 a.m. and 7:00 a.m.

Can I sell alcohol to a customer who appears to be intoxicated?

No, it is illegal to sell or serve alcohol to a customer who appears to be intoxicated in Texas.

How long does it take to receive a TABC license after I submit my application?

The processing time for a TABC license application varies depending on the type of license you’re applying for and the completeness of your application. Generally, it can take anywhere from a few weeks to several months to obtain a TABC license.

Can I apply for a TABC license if I have a criminal record?

It depends on the nature of your criminal record. The TABC may deny a license application if the applicant has a felony conviction or a misdemeanor conviction related to the sale or consumption of alcohol.

If you need assistance with TABC Licenses and Permits for your business, Monshaugen & Van Huff, P.C. is here to help. We have extensive experience in helping clients navigate the complexities of obtaining a Texas Liquor License. Your TABC licensing journey in Texas starts here – be it in Houston, Dallas, San Antonio, Austin, El Paso, or any other Texan city, our team will work diligently to ensure that your application process is smooth and successful.

Call us today at (713) 880-2992 or fill out our contact form to get started